On the 1 st of March 1996 the Inland Revenue Depart of Malaysia became the Inland Revenue Board of Malaysia IRBM which is now what it is formally known as today. Go to Tax Setup General ledger parameters.

Malaysia Sst Sales And Service Tax A Complete Guide

The National Airline of Iran Persian.

. One of the primary reasons MNCs are eager to set up a business base in Malaysia is due to the lower operational costs involved. 20-01 20-02 20-03 Level 20 Menara Centara. Siemens AG Berlin and Munich is a global technology powerhouse that has stood for engineering excellence innovation quality reliability and internationality for more than 170 yearsActive around the world the company focuses on intelligent infrastructure for buildings and distributed energy systems and on automation and digitalization in the process and.

It is advisable that all employers in Malaysia remain aware of the upcoming public holiday dates. In order to bring about greater efficiency in administration speedy implementation of on-going projects better customer care reduction of workload on General Managers etc Indian Railways have decided to create seven new zones by territorial re-adjustment of existing zones. PROMO Be at ease.

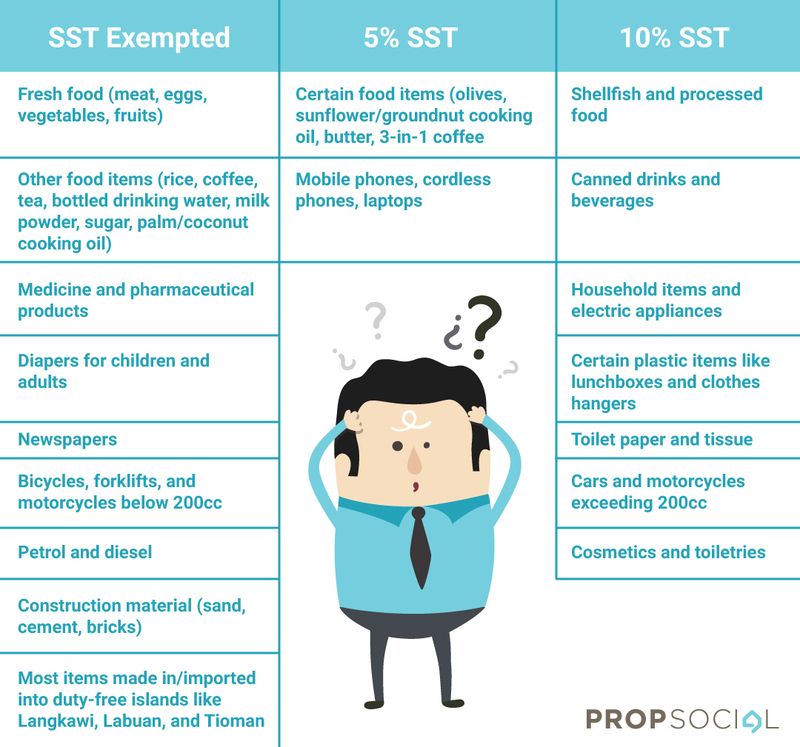

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. What is Sales and Service Tax SST. Overview of SST in Malaysia.

Havâpeymâyi-ye Melli-ye Irân branded as Iran Air is the flag carrier of Iran which is headquartered at Mehrabad Airport in TehranAs of 2018 it operates scheduled services to 71 destinations in Asia and EuropeIran Airs main bases are Tehran International Airport and Mehrabad Airport both situated. Chronology of events that lead to SST implementation Comparison Between SST and GST. SST Return Submission and Payment.

CONTACT INFO Unit No. هواپیمايی ملی ایران romanized. Modernizing your digital systems Srijan is a global engineering firm that builds transformative digital paths to better futures for Fortune.

Srijan Technologies 15233 followers on LinkedIn. 3E Accounting Malaysia is offering affordable pricing for company incorporation and formation services in Selangor Kuala Lumpur Penang Malaysia. Here is provided a chronology of events that lead to SST implementation beginning on 1 September 2018.

Public Holidays in Malaysia for 2022. Melayu Malay 简体中文 Chinese Simplified Roles and Responsibilities of a Company Secretary in Malaysia. Set up General ledger parameters.

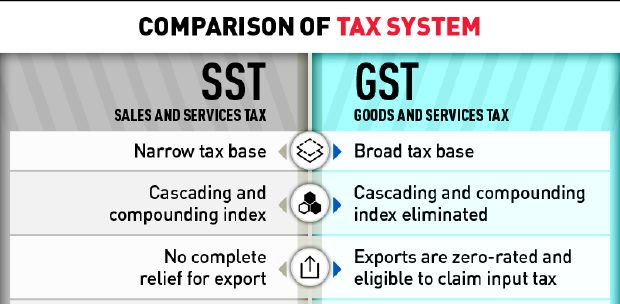

Comparison between SST and GST. How to Check SST Registration Status for A Business in Malaysia. SST might be possible as well prior to the implementation of GST in future years.

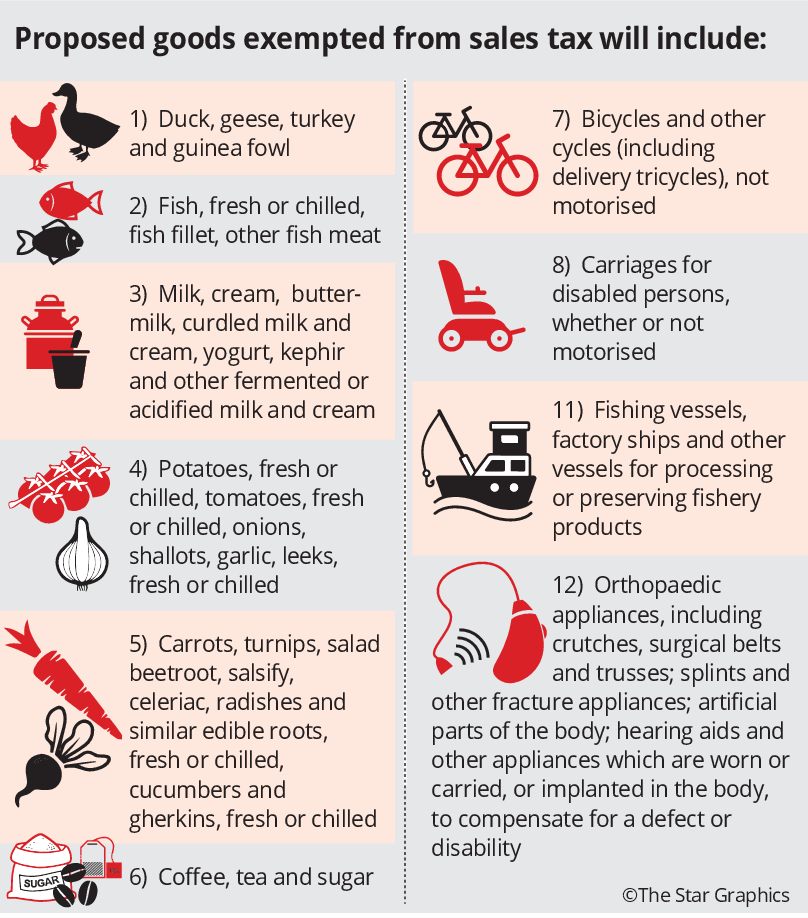

Find out which goods or services are liable to SST when to register and how to pay SST. Malaysia Sales Tax 2018. Before a business can legally start operating businesses are required to comply with some form of licensing which could be a general licence an industrysector specific licence or activity specific licence.

2 Dec 2013 Annexure 1. Melayu Malay 简体中文 Chinese Simplified Inland Revenue Board of Malaysia IRBM Income Tax Department. The system is thus based on the taxpayers ability to pay.

New foreign workers entering Malaysia on or after 1 January 2019 have to register with SOCSO once they are validated by the Immigration Department of Malaysia at any gazetted port of entry. To generate the SST-02 return form report in Excel you must define an ER format on the General ledger parameters page. The Prime Ministers Department in Malaysia has announced the dates of the upcoming public holidays in Malaysia.

The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements. Another source for the government is higher commodity prices related to revenues. GST implementation is unlikely to be in 2023.

Malaysia is the third largest economy in South East Asia and has now become an upper middle income and export-oriented economy. Malaysia has transformed into an international financial hub that attracts a large pool of foreign talents ie. As Malaysia has entered the endemic phase economic activities.

Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. This post is also available in.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. Get SST news in Malaysia. The current prosperity tax will not be extended in 2023.

Amendments to the Participating Organisations Trading Manual in Relation to Dynamic Price Limits and The Implementation of a New Bursa Trading System Effective. Implementation of sales and service tax sst In accordance with the implementation of Service Tax Act 2018 Service Tax ST is to be charged at six percent for all taxable products and services provided by TM Group effective 1 September 2018. On the Sales tax tab in the Tax options section in the Electronic reporting field select SST-02 Declaration Excel MYIf you leave the SST statement format.

This post is also available in. Melayu Malay 简体中文 Chinese Simplified Memorandum and Articles of Association MA Constitution in Malaysia. Employees Exempted From the Coverage of the Employees Social Security Act 1969 Are as.

This post is also available in. This post is also available in. Rule Amendments - in Relation to Dynamic Limits.

SST Treatment in Designated Area and Special Area. Melayu Malay 简体中文 Chinese Simplified MNCs in Malaysia. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime.

New promotional products have returned with the PWP. Please refer to the table below for a comparison of two tax system. Melayu Malay 简体中文 Chinese Simplified Business Licences in Malaysia.

In Malaysia Memorandum and Article of Association MA are part of the registration documents in company incorporationGenerally speaking the Memorandum of Association outlines and elaborates the essential components. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. And the financial reporting framework serves as a guideline to ensure each criterion that is needed is being fulfilled.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Learn about SST within Malaysia. The appointment of Company Secretary is part of the legal requirement according to the Companies Act 1965 every company must appoint at least one secretary a company is allowed to appoint more than one secretary.

Goods and Person Exempted from Sales Tax. IRBM in Malaysia is one of the main agencies responsible. This ensures the better management of manpower and smooth operational transitions.

SST Registration in Malaysia. SST Penalties and Offences in Malaysia. Service Tax on Hotels.

NOTICE PAKISTAN Operate by Enagic Malaysia Sdn Bhd. Malaysia Service Tax 2018. This post is also available in.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Territorial Readjustment of Zones and In-House Reforms. Amendments to the Rules of Bursa Malaysia Securities Berhad in Relation to Dynamic Price Limits 2.

Welcome Back Sst So What S New Propsocial

Malaysia Sst Advisory Planning Malaysia Tax Accounting Consulting Firm

Tokenize Malaysia Dear Tokenizers Beginning From The 14th Of June 2021 There Will Be A 6 Sales Service Tax Sst Levied On The Trading Fees On Tokenize Xchange Malaysia

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

No Sst For Essential Items The Star

Doc Article 2 An Overview Of Gst Malaysia Brief History Of Goods Services Tax Gst Malaysia Yeehui Hayley Academia Edu

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Knowing Malaysia S Gst Vs Sst Knowing The Difference

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Malaysia S Inflation To Gradually Rise After Sst Implementation

Sst Will Hurt Consumer Purchasing Power Less Kpmg Kpmg Malaysia

Gst Better Than Sst Say Experts

Supplier Relationship Management Gst

Insight Is The Gst Coming Back The Star

Malaysian Taxation The Tasks Ahead For Sst Asia Research News

2020 Sst Exemption New Volvo Price List Announced Up To Rm23 078 Or 6 52 Cheaper Until December 31 Paultan Org Automoto Tale